Overlap relief (Self Assessment helpsheet HS260)

Find out how to work out Foreign Tax Credit Relief if you have overlap profits or you're claiming overlap relief.

Documents

Details

This guide will help you to work out Foreign Tax Credit Relief (FTCR) if you’re now claiming overlap relief or you have overlap profits.

Use:

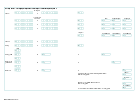

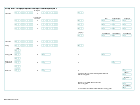

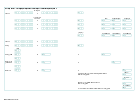

- working sheet 1 if you have overlap profits and need to work out FTCR

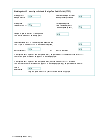

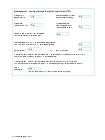

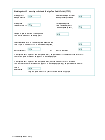

- working sheet 2 if you’re claiming overlap relief and need to work out the FTCR that will be recovered

Last updated 6 April 2024 + show all updates

-

The helpsheet and working sheets have been added for the tax year 2023 to 2024. The helpsheet and working sheets for the tax year 2019 to 2020 have been removed.

-

The helpsheet and working sheets have been added for the tax year 2022 to 2023. The helpsheet and working sheets for the tax year 2018 to 2019 have been removed.

-

We have added the helpsheet and worksheets for 2022. Helpsheets and worksheets from 2017 to 2018 have been removed.

-

The helpsheet and working sheets have been added for the tax year 2020 to 2021.

-

The helpsheet and working sheets have been added for the tax year 2019 to 2020.

-

The helpsheet and working sheets have been added for the tax year 2018 to 2019.

-

The helpsheet and working sheets have been added for the tax year 2017 to 2018.

-

The helpsheet and working sheets have been added for the tax year 2016 to 2017.

-

Rates, allowances and duties have been updated for the tax year 2016 to 2017.

-

Rates, allowances and duties have been updated for the tax year 2015 to 2016.

-

First published.